The national statistics for June won’t be out for a couple of weeks yet, but an analysis from RBC of early regional reports points to a continued slowdown in housing markets across the country.

In a note titled “Canada’s Housing Markets Keep on Cooling”, RBC Economist Claire Fan writes that as demand drops, markets are returning to balanced conditions. She also notes that while prices remain elevated compared to the same time frame in 2021, month-over-month trends show a clear softening in home values.

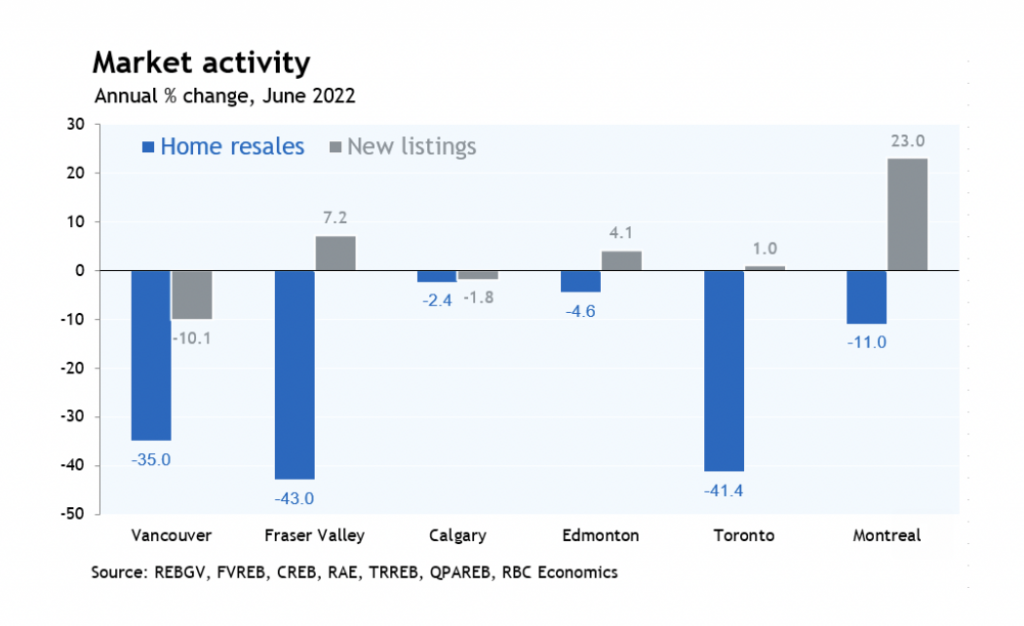

These trends were noted in Canada’s biggest urban centers such as Toronto, Vancouver, Montreal, and Calgary, which all “witnessed further declines in home sales in June as markets continue to reverse their pandemic surge following rising borrowing costs with the Bank of Canada pushing interest rates higher,” she writes.

As well, there’s a clear correlation between today’s slowing markets, and regions that saw the strongest run-ups during the pandemic, including Toronto and Vancouver.

“These regions have been more sensitive to early interest rate increases due to higher average home prices and larger mortgage sizes. Home sales in Toronto and Vancouver declined 41% and 35%, respectively year over year in June. Weakness in single-detached home sales led the contraction across the board,” Fan writes.

The June report from the Toronto Regional Real Estate Board shows sales are down 41% year over year, and 11% below May activity. Prices, while still up 5.3% on an annual basis at an average of $1,146,254, are down by 5.4% compared to the previous month, and a whopping 14% from the market’s February peak.

In Metro Vancouver, home sales plummeted 35% in June from the year before, and were down 16.2% from May. The benchmark home price in the region came in at $1,235,900, a 2.2% decrease over the past three months (though still up 12.4% year over year).

A positive trend, Fan points out, is the resurgence of supply; healthier inventory levels have helped ease sales-to-new-listings ratios (a measure that gauges the level of competition in the market), lower for all regions. “In fact,” she writes, “all areas except for Calgary have now swung back into a balanced market condition. That’s a stark contrast from just a few months ago when virtually all local markets were tracking firmly in favor of sellers.”

Overall inventory improved in Toronto, Vancouver, and Calgary, ending a long streak of declines seen in the past few years.

This trend is set to continue as headwinds such as rising interest rates will accelerate over the summer, delivering the double whammy of deteriorating affordability, and higher carrying costs.

“That should work to erode housing affordability further, put more buyers on the sidelines, and push prices lower,” Fan writes.

Click here for the source