Home sales decline, average selling price remains flat

Home sales in the Toronto area declined on a year-over-year basis in August while the average selling price remained flat, as rising borrowing costs continued to weigh on the region’s real estate market.

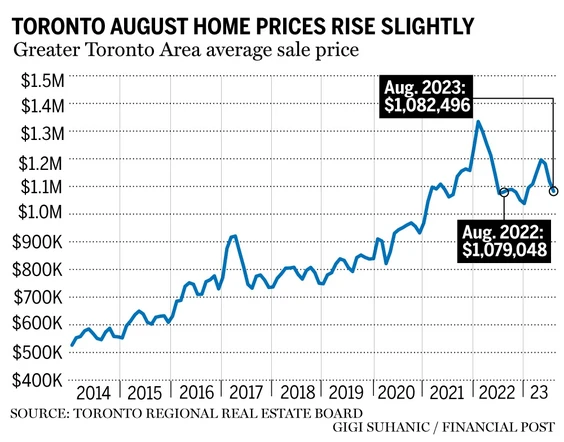

Though the MLS Home Price Index and average prices inched up 2.5 per cent and less than a per cent, respectively, on a year-over-year basis, average prices fell slightly from July to $1,082,496, according to monthly data from the Toronto Regional Real Estate Board.

The Sept. 6 report also noted 5,294 sales were completed in August, a decline of 5.2 per cent from the same period last year. New listings increased by 16.2 per cent year over year, but year-to-date listings still trail significantly behind last year’s figures.

According to TRREB, the reduction in sales combined with a monthly decline in the seasonally adjusted average price, suggested a cooling of the market.

TRREB president Paul Baron said buyers were closely watching borrowing costs and the state of the economy.

“Looking forward, we know there will be solid demand for housing — both ownership and rental — in the Greater Toronto Area (GTA) and broader Greater Golden Horseshoe. Record immigration levels alone will assure this,” Baron said. “In the short term, we will likely continue to see some volatility in terms of sales and home prices, as buyers and sellers wait for more certainty on the direction of borrowing costs and the overall economy.”

Toronto realtor Cailey Heaps believes the August results had less to do with economic factors and more to do with potential homebuyers trying to make the most of the end of summer.

“The sales were down in August, but I don’t think it’s truly reflective of the market,” Heaps said. “I don’t think it’s tied to interest rates. I don’t think it’s tied to the market. I think it’s tied to people wanting to enjoy the final weeks of a very short summer.”

Heaps predicts a resurgence of interest in the market after Labour Day, a trend often observed in Toronto’s real estate landscape. The Bank of Canada’s decision to maintain rates at five per cent on Sept. 6 and the impending increase in the land transfer tax, as proposed by Toronto Mayor Olivia Chow could bolster the fall market even further.

“It will fuel the fall market if there is an increased land transfer tax because it would take effect Jan. 1. I think people would want to get in and close (on a property) before then,” she said.

Heaps was one of the few in the industry to discount the impact of interest rates. Pritesh Parekh, a Century 21 realtor in Toronto, said borrowing costs indeed influenced August’s market dynamics.

He attributed lower prices to budget-conscious buyers, who were unwilling to push the envelope on costs.

“They went under their budget just to be comfortable and ensure that they have that wiggle room if the rates do continue to go up,” he said.